Creating a sales invoice in Giddh is simple and helps track your revenue accurately. Follow the steps below to generate an invoice for your sales transactions.

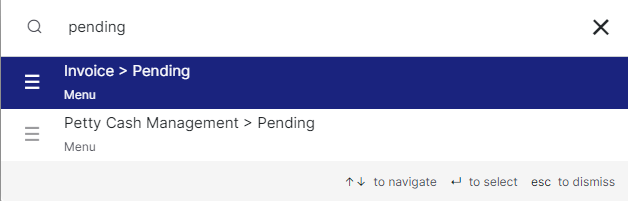

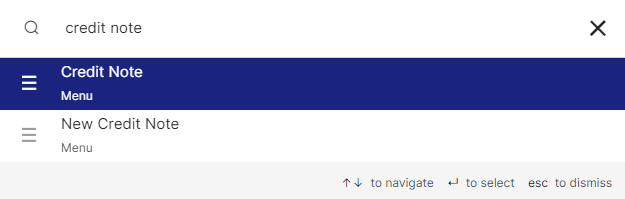

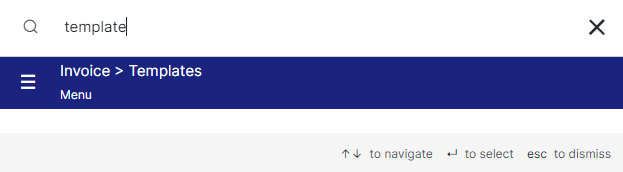

🔐 Step 1: Log in and Use Search for Quick Access

Log in with your registered email ID and password.

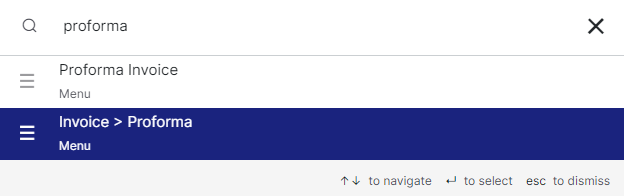

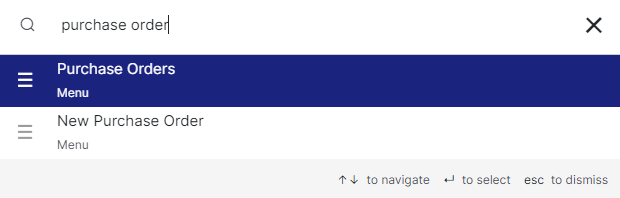

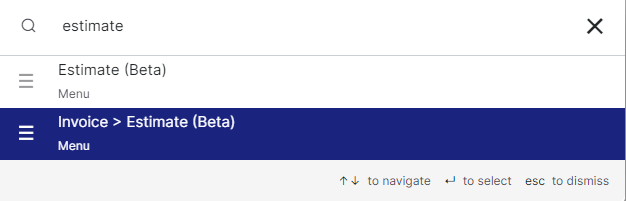

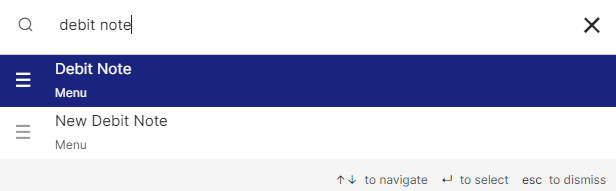

Once logged in Giddh, you can quickly search for any module or feature using:

Ctrl + G for Windows or Cmd + G for Mac

Type "Sales Invoice" in the search bar to navigate directly to the invoice section.

OR

Please refer to this link for the Sales Invoice page:

https://books.giddh.com/pages/vouchers/sales/create

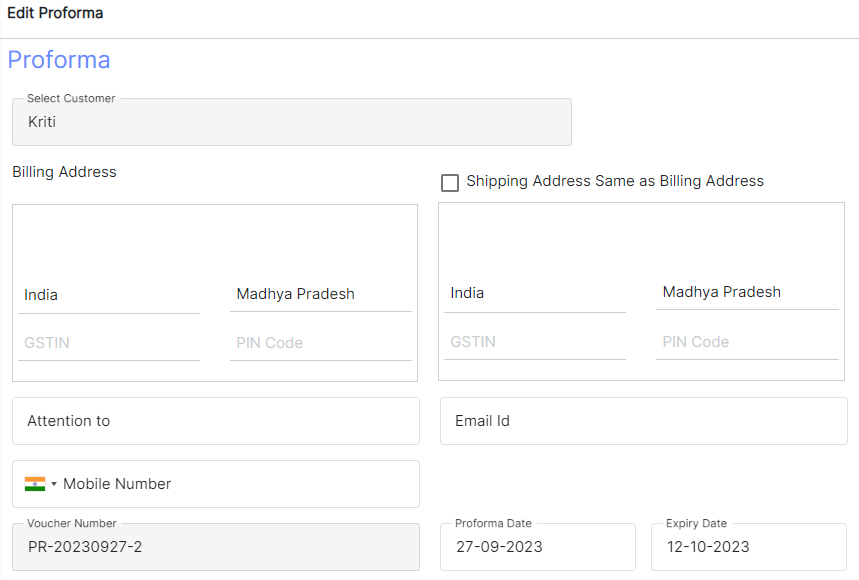

👤 Step 2: Add or Select a Customer

Click on "Add Customer"

Enter required details such as: Customer Name, GST(if applicable), Billing Address, PIN code, Select party type

Contact Details:- Contact number and Mail id.

These details will be saved in your master records for future use.

.webp)

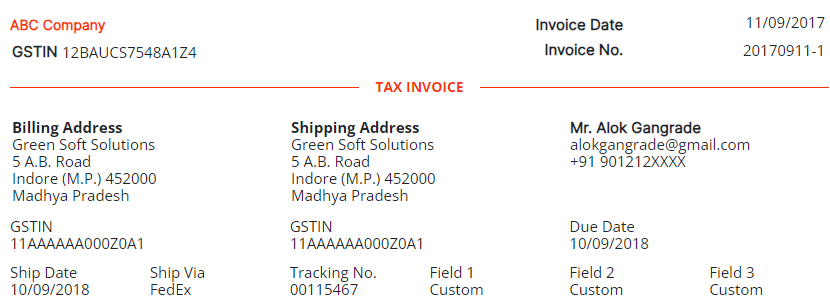

🧾 Step 3: Fill Invoice Details

Now fill out the invoice basics:

Contact details – Enter the customer's contact number and email address

Invoice Date – Select the current date or any relevant billing date based on when the transaction occurred.

Due Date (Optional)– Specify the payment due date if it’s a credit-based transaction. This helps in tracking receivables and sending payment reminders.

Terms –Indicate whether the transaction is applicable under Reverse Charge Mechanism (RCM).

.webp)

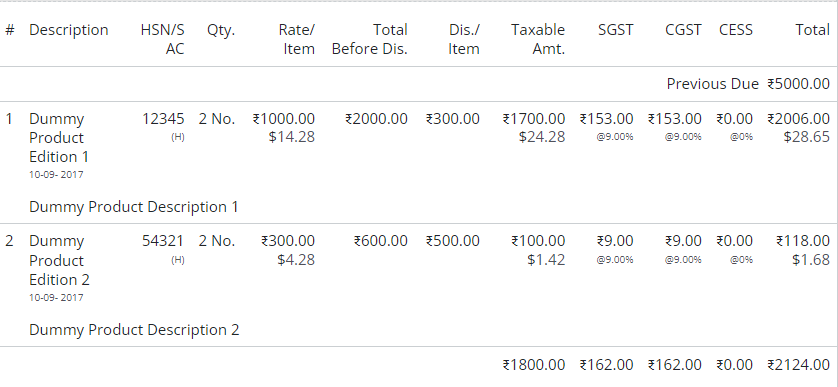

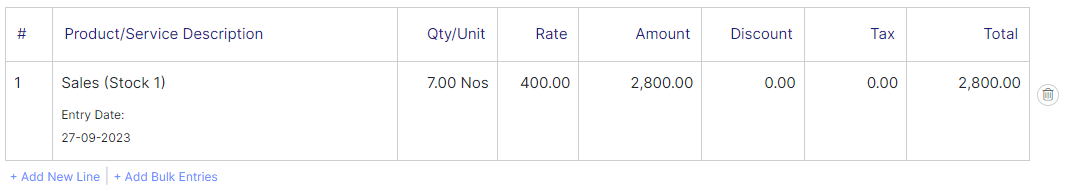

📦 Step 4: Add Product/Service Information

Click on “Product/Service” to add products or services.

For Each Item, Fill in the Following Details:

Item Name: Enter the name of the product or service you are billing for.

Rate/Price: Enter the rate or unit price for the item or service.

Tax (GST): Choose the applicable tax rate based on your item and place of supply:

Discount (Fixed or %): You can apply either:

A fixed discount amount (e.g., ₹500 off)

Or a percentage-based discount (e.g., 10%)

If you have many items to add, click on “Add Bulk Entries” to upload or input multiple items quickly.

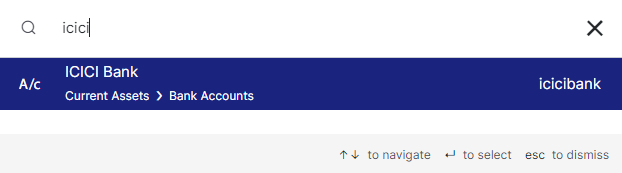

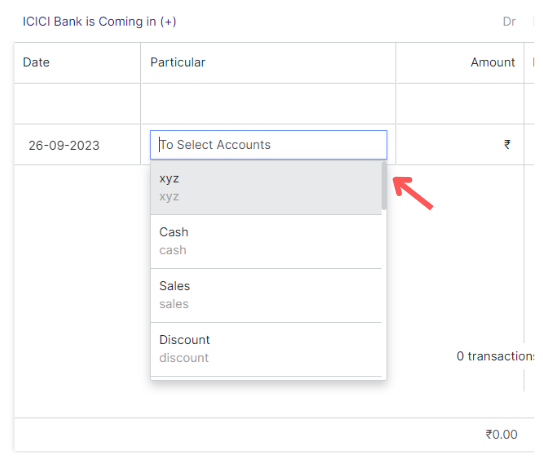

💰 Step 5: Select Payment Mode

Once you’ve added all invoice details and items:

Scroll to the bottom of the invoice page and click on "Select Account."

A list of your Cash and Bank accounts (from your Chart of Accounts) will appear.

Choose the appropriate account where the payment is being received, such as:

Cash – if the payment was made in hand.

Bank Account – if received via NEFT, UPI, cheque, or any bank transfer.

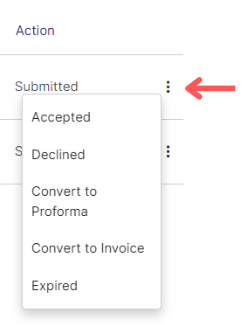

Step 6: Choose Action Type (optional)

Once all details are entered, Click on the “Other Details” button (Optional):

Fill in the optional fields:

Ship Date – Date of shipment

Ship Via – Mode of transport (e.g., courier, transport agency)

Tracking No. – Shipment tracking number

Add Note – Any additional remarks for internal use or customer reference

Attach Voucher – Upload any supporting document or payment proof if required

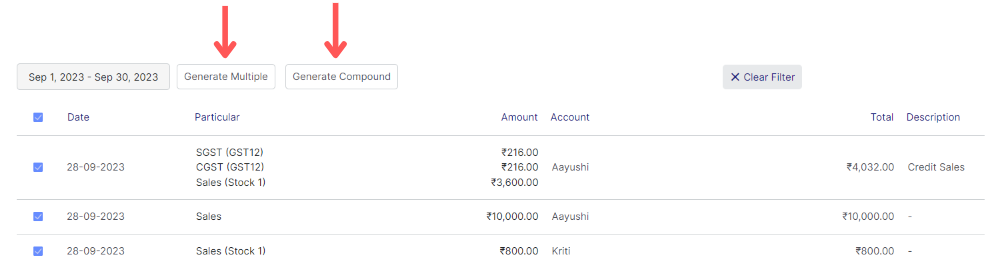

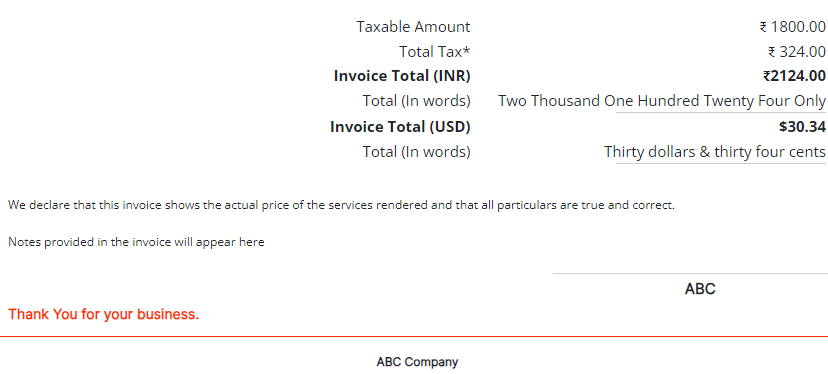

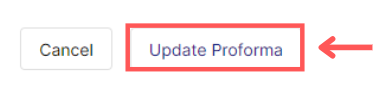

Step 7:Generate and Finalize the Invoice

Generates the invoice and sends it directly via email or SMS (ensure SendGrid/Msg91 is configured).

Once all the information is reviewed: Click on “Generate Invoice”.

.webp)

.webp)

.webp)

.webp)

.png)

.png)

.png)

.png)

.jpg)

.jpg)

.jpg)